The low-carbon energy transition raises questions about the future of the energy economy and jobs in the United States. A new Energy Futures Initiative (EFI) policy paper provides initial answers. It is based on an earlier analysis by the Labor Energy Partnership (LEP)—a collaboration between EFI and the American Federation of Labor and Congress of Industrial Organizations (AFL-CIO). This work began last year, following the passage of the Infrastructure Investment and Jobs Act (IIJA) and introduction of the Inflation Reduction Act (IRA). The policy paper is titled, Jobs, Emissions, and Economic Growth—What the Inflation Reduction Act Means for Working Families, and it focuses on what the IRA adds to the story of jobs in the clean energy transition.

EFI CEO Ernest Moniz, EFI Distinguished Associate David Foster, and Alliance to Save Energy President Paula Glover discussed the policy paper during OurEnergyPolicy’s (OEP) Energy Leaders Event Series on January 12, 2023. The conversation centered on projected impacts of the IRA. While discussing the policy paper at the OEP event, Moniz called the IRA the “most aggressive climate legislation we have seen [in the United States].”

“The good news is [with the IRA], what you want to go up, goes up, like GDP [gross domestic product], jobs, and disposable income, and what you want to go down, goes down, like energy use, energy costs, inflation, and greenhouse gas emissions,” Moniz explained. “The conclusion upfront is that this is actually a quite substantial piece of legislation…it’s unusual in a number of ways.” One of the factors that make the IRA unusual is its $304 billion in deficit reduction, Moniz said.

Foster delved deeper into the report, which uses three complementary models of the U.S. economy, energy systems, and regional emissions to broadly assess the IRA. He explained that the new model compares a base case scenario (with all legislation up to/including the IIJA) to a scenario that also adds the IRA to isolate its impact on the climate, economy, and jobs.

According to the analysis, the IRA achieves a 37% reduction in greenhouse gas emissions (compared to 2005 levels) by 2030 and a 40% reduction by 2032. It also lowers energy demand nearly 6% by 2032. The IRA scenario reveals other economy-wide impacts, such as $250 billion in GDP growth by 2030. It further indicates that the IRA has no negative consequences for inflation; it lowers inflation at a slightly faster pace from 2024 and 2025, but inflation stabilizes at 2% by 2030 in either case.

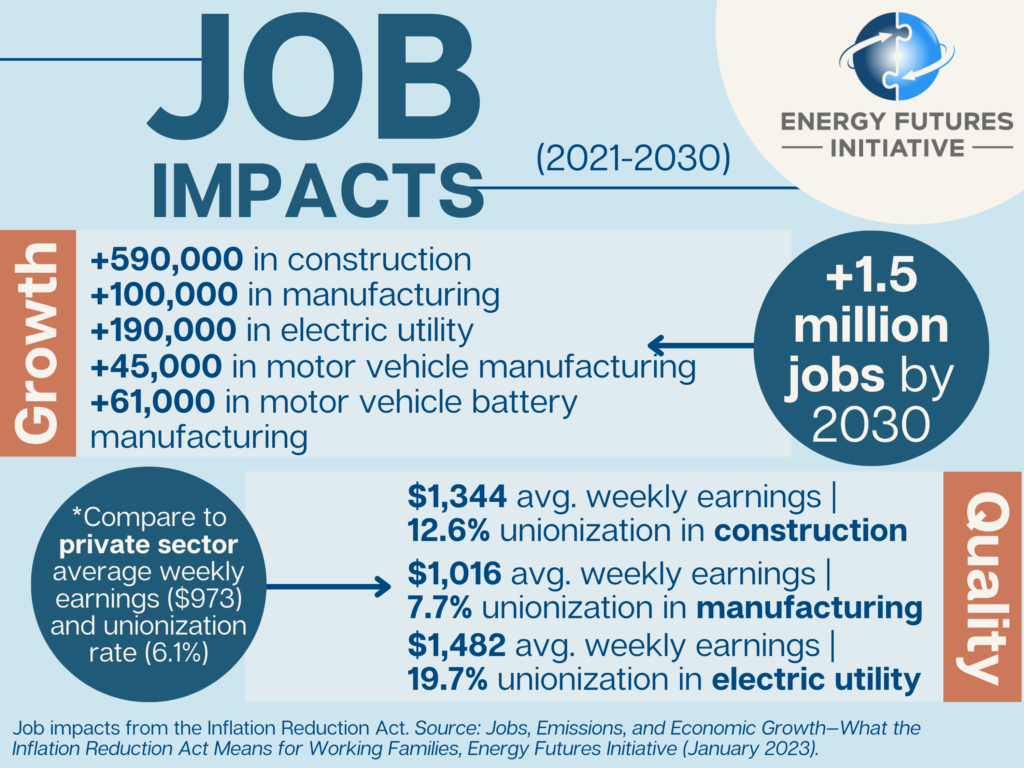

The report’s findings are particularly insightful for understanding the IRA’s impact on the workforce, showing that it adds an additional 1.5 million new jobs to the U.S. economy by 2030.

Foster emphasized that the IRA’s targeted investment in energy efficiency, tax credit stipulations, and domestic content creation requirements allow for more robust job creation than would be possible without the legislation.

He also highlighted the electric utilities sector to illustrate how, despite the shift from internal combustion engines to electric batteries in motor vehicle manufacturing, job gains are likely to offset—and even outpace—job losses during the energy transition.

In addition to job availability, job quality in the energy sector is a concern.

“There is a common misunderstanding or assumption that if the jobs you create are higher paying, there are going to be fewer of them,” Foster said.

The analysis gauges the IRA’s impact on job quality in key energy areas, such as construction, manufacturing, and electric utility, through wages and unionization rates. The results show that these areas have higher average median weekly earnings and unionization rates compared to the overall U.S. economy.

Foster explained that the analysis tells a “very positive narrative about the IRA” by illustrating that the negative effects of climate investment are more than outweighed by the benefits. He also noted that the IRA presents novel opportunities to address social equity.

Social equity in the energy transition ensures that the workforce is unharmed in the pursuit of decarbonization goals. “[It provides] a future in the low-carbon world for…communities and workers,” Moniz said.

Foster emphasized that the low-carbon energy transition is very different from previous transitions. Unlike those that occurred in the 1980s and 1990s within the steel industry, energy jobs and businesses are transforming, not disappearing.

Many of the workers and companies in fossil fuel extraction already possess skills, and are in geographies, that are useful for the transition, Moniz explained.

However, sectors like manufacturing require a workforce development system to navigate the continuing developments in American manufacturing caused by digital technology, Foster said.

Foster and Moniz explained that one of the ways the IRA attends to workforce development is through apprenticeships, which train people for jobs that are critical to the energy transition.

These opportunities help achieve social equity goals while strengthening domestic supply chains. Moniz underscored the importance of “supply chain hygiene,” especially in areas such as metals and minerals, for achieving social equity in the clean energy transition.

“Social equity concerns and the climate need to be addressed together,” Moniz said. There must be a bottom-up focus on how communities are affected by the clean energy transition. Supporting quality job growth, while avoiding stranded workers and communities, is critical to a successful transition.

— Jaycee Scanlon, Communications Fellow

Related Content

(Share this post with others.)