“Energy Infrastructure Modernization is Critical for Addressing Climate Change, Energy Security, and Jobs” March 22, 2021

Mr. Chairman, ranking member Rodgers, members of the Committee, thank you for the opportunity to testify today and to discuss the LIFT America Act.

Coming on the heels of the disaster in Texas, this hearing and the LIFT America Act’s focus on improving the nation’s energy infrastructure, is very timely. The recent events in Texas serve as a wakeup call for many things Congress should consider and address as it works to help modernize the nation’s energy infrastructure.

The Texas experience puts an exclamation point on a broad range of domestic and global activities and actions now underway. As we all know, the Biden Administration has re-joined the Paris Agreement and is working to develop a new NDC for the United States. In addition, roughly 130 of 196 nations around the world have committed to or are actively considering net zero emissions targets by mid-century. More than half of the U.S population lives in a state or city with an emissions reduction target of 80% or greater by midcentury. Also, the European Union is developing a carbon border adjustment policy scheduled to be released this summer. And finally, the COVID pandemic serves as a constant and critical reminder of the ongoing need for jobs and the almost unparalleled need to support an economic recovery plan.

We made energy infrastructure an early priority in my tenure as Secretary at DOE with the drafting and publication of the first installment of the Quadrennial Energy Review, or QER, which was focused on energy infrastructures, including shared infrastructures. This installment made 63 recommendations for building a smarter, cleaner electric grid; promoting workforce training and development; reducing emissions from natural gas systems; supporting the re-investment into our critical waterborne transport systems; and enabling improved siting and permitting issues that are critical steps for deploying innovative systems to the market. By the end of my tenure, 29 of QER1.1’s 63 recommendations had been implemented fully, with 21 more underway. It is worth noting that that the first installment of the QER included a section specifically focused on the 2011 cold snap in Texas and New Mexico, emphasizing the growing interdependencies of the electricity and natural gas infrastructures, borne out by events in Texas 10 years later (see Text Box 1).

The second installment of the QER focused specifically on the grid: “Transforming the Nation’s Electricity System”. This installment evaluated the centrality of the electric grid to the nation’ economic health, national and energy security, and the social lives of our citizens. It recommended flexible financing for developing a clean, modernized grid; ensuring the electric grid is prepared for growing risks of anthropogenic climate change and cyber-attacks; building capacity at the federal, state, and local levels to support the grid’s regulatory and policy requirements; and maximizing consumer equity and economic value of the system.

I am pleased to see that some of the provisions of the LIFT America Act align with QER recommendations, including the establishment of a Strategic Transformer Reserve and the natural gas infrastructure grant program. A summary of recommendations from both QER installments has been entered into the record as attachments to this testimony. The non-profit Energy Futures Initiative (EFI) that I founded with two colleagues from DOE has continued work on some of the QER recommendations, in particular the development and release of the annual U.S. Energy & Employment Report.

Only four years have passed since we issued the last installment of the QER in January 2017 but the urgency of upgrading our energy infrastructure in service of a deeply decarbonized economy has become even clearer. The advances in climate science and the realities of extreme weather call for action, as advocated by this committee with the LIFT America Act and other initiatives, such as the CLEAN Future Act introduced earlier this month.

In looking ahead to infrastructure needs, it is useful to focus on a number of technologies that will almost certainly play major roles in a deeply decarbonized economy:

- Electricity and the grid: The electric sector is leading the way on decarbonization and will continue in that role. A reliable and resilient grid will also continue to be the central infrastructure on which other infrastructures depend. How that grid is configured will have to be matched to the mix of critical generation and storage technologies: variable renewables wind and solar, batteries and long duration storage, advanced nuclear technologies (fission and fusion), fossil power plants with carbon capture, utilization, and sequestration (CCUS).

- Electrification of other economic sectors, especially transportation: Momentum has continued to build for electric vehicles (EV), a fact that is underscored by recent announcements from major automakers. An elaborate continental scale charging infrastructure will be needed. In turn, vehicles connected to the grid might make a major contribution to grid services.

- Large scale carbon management: CCUS at gigaton scale from power plants and industrial facilities will require a major CO2 pipeline infrastructure and significant hubs for geological CO2 storage. In addition, reaching net zero emissions — and eventually net negative emissions — throughout the economy will require carbon dioxide removal (CDR) from the atmosphere and upper ocean layers. Many CDR pathways — direct air capture (DAC)biomass energy with CCS (BECCS), and in-situ mineralization — will depend on large scale carbon management infrastructures.

- “Fuels” to complement clean electricity: It is very unlikely that efficiently decarbonizing the economy can be fully achieved through electrification only. A low-carbon fuel will be needed, and the general view today is that hydrogen is the most likely candidate. This will require yet another major infrastructure for the use of hydrogen — a highly flexible fuel that could assume the critical role currently played by natural gas — in multiple sectors over the next decades. Blue hydrogen (i.e., made from natural gas with the emitted CO2 undergoing CCUS) will also utilize the large-scale carbon management infrastructure in addition to the hydrogen infrastructure needed for green hydrogen (i.e., made by electrolysis of water).

While only a partial list, this set of new infrastructure needs has a clear connection to decarbonization while maintaining the reliability and resilience of the grid and supporting the significant economic activity and essential services that are currently associated with conventional fuel use. These critical needs cannot be met without a major commitment to infrastructure, and the LIFT America act sets us on that pathway.

The Central Role of Electricity

First and foremost, the recent Texas experience underscores the critical and central role electricity plays in our lives, the economy, and the nation’s security. No systems in Texas were fully operational without electricity, the “uber” infrastructure.

This experience, the rolling blackouts in California due to the Western heat wave last August and numerous other weather-driven catastrophes, drive home an essential consideration going forward: energy infrastructures, especially the grid, are very exposed to the impacts of climate change. As we increase our focus on the electrification of several sectors and subsectors — a key decarbonization strategy — the Texas experience and this exposure reminds us that the reliability and resilience of the grid is a critical consideration and need. Research, development, and demonstration of grid resilience technologies will be critically important to preserving reliability, an essential role of the federal government.

It also drives home another key point: climate change means that the weather patterns of the past are not adequate to inform those of the future. This changed risk profile affects infrastructure from design, to investment, to buildout, to insuring the system. As we increase electrification of key sectors, we must thoughtfully approach these requirements for, and risks to, a modernized electric grid. In addition, increased electrification of other parts of the economy necessitates a substantial buildout of the grid system, from transmission lines to substations and transformers, to distribution systems and EV charging stations, all the way to heat pumps for homes.

Another critical part of the future grid will be a set of technologies that supply large scale, long duration storage to support wind and solar generation. As seen in Figure 1, in 2017, California had 90 days with little to no wind, sometimes 10–11 days in a row. Deployed grid-scale battery storage has a duration of around four hours.

Even with continued innovation, batteries will likely be used for intraday storage needs. We need innovation in long duration storage — days, weeks, and seasonal — complemented by different generation technologies (such as advanced nuclear and CCS) and market structures that support clean firm power as well.

Modernizing the Existing Electricity Grid Infrastructure. As noted, the electric grid is the “uber infrastructure” — the backbone of our economy and social interactions, central to meeting health and safety needs, and critical to our national security. It touches everything and will be a critical enabler of, and contributor to, decarbonization. Due to its outsized importance, combined with emerging trends, electric grid modernization must meet multiple objectives: providing clean, reliable service to growing demand; promoting social equity and inclusion; ensuring resilient performance in the face of a changing climate and increasing cyber threats; integrating distributed sources of clean electricity; and supporting broad connectivity throughout the system to enable smarter cities and communities.

Managing an electric grid that is the size and complexity of the U.S. system is a major challenge. There are already 642,000 miles of high voltage transmission lines and 6.3 million miles of distribution lines in the U.S.1 As the US transitions to a clean energy future, the electric grid will require many billions of dollars of investment over the coming years.

Connecting renewable energy from remote areas to urban centers, for example, will require a significant transmission system buildout. Expanding the role of federal power marketing authorities in building out new transmission could help add long-distance bulk transmission capacity. EFI and Energy and Environmental Economics (E3) completed a study last year on decarbonizing New England’s economy and electric grid. The study found that by mid-century, electricity demand would grow by 60–90% from current levels. This would require massive investments in the associated buildout of the grid infrastructure, especially to access more Canadian hydropower and to accommodate a massive new offshore wind development.

There are several actions that could facilitate the deployment of new transmission that will be necessary for deep decarbonization. Permitting could be streamlined in a number of ways in a broad stakeholder process: a pre-approval optional process for state and local authorities; centralizing certain kinds of transmission permitting in a single authority (such as FERC); harnessing existing rights of way for rail, pipelines, interstate highways, and other infrastructure so as to minimize eminent domain requirements and public opposition; tailoring permitting procedures for new kinds of infrastructure like CO2 transport/DAC; empowering decisionmakers to resolve intragovernmental dispute; conducting multiagency reviews in parallel rather than sequentially; and ensuring Tribal sovereignty/input.

Modernizing the grid will also depend on updating today’s electricity market design. The current wholesale electricity market design is increasingly challenged to reconcile the integration of intermittent generation sources with the need to ensure reliability by maintaining clean firm power generation. Moving to a net zero electricity generation regime will further amplify these challenges. Rectifying this problem could involve redesigning the electricity market to better accommodate existing subnational and proposed national decarbonization policy initiatives, lower barriers to new technology, encourage demand-side participation, value more attributes of resources, and better meet reliability needs. Congress could initiate a review of federal policy on wholesale market design.

Electric Vehicle Infrastructure. Over a quarter of US emissions come from the transportation sector, the nation’s largest emitting sector; on-road vehicles comprise 23% of US emissions. Moving to a mid-century net- zero economy will require electrification of nearly all light-duty vehicles, as well as significant percentages of other transportation subsectors.

Foreign and domestic manufacturers have announced substantial investments in electric vehicles, with General Motors, for example, committing to discontinuing new internal combustion models by 2035. Infrastructure options and associated policy support will likely have to accommodate battery electric vehicles and plug-in hybrids, hydrogen fuel cell vehicles and vehicles that run on biofuels. Emissions-free liquid fuels likely will garner some market share, and policies to improve fuel economy of new models and encourage mode- switching will continue to be important.

On a global scale, the IEA Sustainable Development Scenario estimates an increase in EVs from five million in 2019 to about 140 million by 2030. This would require a rapid scale up from the current global battery manufacturing capacity of 193 GWh (41 of which are in the U.S.) by an order of magnitude. Likewise, public chargers would need to scale by orders of magnitude to numbers in the millions by 2030, compared to around 100,000 today. It would also require vastly more supply of cobalt and lithium, supplies of which currently depend on imports. There is also global competition for these critical supplies of mineral and metals, as well as a concentration in China of the processing needed, for lithium-ion batteries.

To support this enormous demand growth – essential for meeting climate imperatives — EV infrastructure must be scaled up rapidly in the next three to five years. This buildout includes supply infrastructure, private and public chargers, as well as the electricity system and building upgrades needed to accommodate them. Additional infrastructure will be needed to support vehicle-to-grid integration and managed charging, which can mitigate the potential impacts of vehicle charging on electricity demand.

Federal policy will be necessary to accelerate the development and deployment all three types of EV infrastructure at a pace sufficient to meet deep decarbonization targets. Supply infrastructure could be supported by a combination of incentives, such as rebates and grant programs; or mandates, such as inclusion in state energy plans or building codes. Federal programs for zero-emissions vehicles have been designed around biofuels, and some of these programs can be reoriented to reflect the growing dominance of EVs in the energy transition. As the Federal government incentivizes and supports buildout of an EV charging network, a core design element must include serving areas where individual home charging stations are not possible (e.g., urban areas with predominantly on-street parking).

It is also crucial to ensure that EV infrastructure is deployed equitably. In the past, vehicle electrification incentives have benefited people at higher incomes, due to EV’s higher upfront costs and the requirements of at-home charging; new policies can shift this dynamic as EVs become cheaper and more widespread.

Battery supply is also a critical need. Federal incentives like the DOE Advanced Technology Vehicles Manufacturing Loan Program have already supported the growth of domestic battery manufacturing, funding battery factories for Tesla and Nissan. More incentives will be important, as well as RD&D investment to reduce battery cost and improve performance. IP protection is also essential to create the necessary environment for innovation and investment.

Battery supply considerations must also accommodate supply chains for the metals and minerals necessary to manufacture batteries, such as lithium and cobalt; domestic net-zero mining, and the buildout of the infrastructure needed for battery manufacturing itself, will become essential (a more detailed discussion of these issues is found on page 10). This will be an area of increasing global competition, and support for domestic supply chains and protection of the intellectual property of innovators will be essential.

The metals and minerals supply chain requires development of a framework for sustainable domestic mining, as well as RD&D on new sources for these materials. Innovation can also help develop substitutes, as well as batteries with lesser critical material needs. Policies that establish producer responsibility for used batteries can encourage the development of new technologies, chemistries, and systems. Innovation could enable cost reduction, reduce dependence on imports of critical metals and minerals, and open the door to the development of new battery technologies.

EFI is undertaking research on supply chain issues, with a focus on expanding domestic supplies of metals and minerals. New domestic sources of lithium are already being explored, and innovation could develop alternatives and/or additional supply, such as geothermal brines in places like California’s Salton Sea. More domestic mining would allow for a bigger push to make battery supply chains more environmentally sustainable, as well as provide a bulwark against the frequent price fluctuations of these commodities. Innovation could also make improvements further down the supply chain, by reducing the quantities of critical materials required and increasing recycling options and opportunities. Figure 2 shows the steps in EV battery production for the EU, US and China, and the relative shares of each country/region in supplying those steps.

Offshore Wind: Renewable Electricity with Major Infrastructure and Supply Chain Needs. Offshore wind (OSW) is poised to significantly contribute to decarbonizing the power sector by 2035, boosting the reliability and resiliency of a modernized national electric grid infrastructure. It provides a good example of the importance of infrastructure planning to enable a critical low-carbon pathway and create lots of good jobs.

Offshore wind projects face significant barriers to adoption, however, including: 1) long and uncertain permitting processes that increase costs and threaten access to tax incentives for project investment; 2) high costs and insufficient financial incentives to build transmission lines to connect offshore wind to shore; and 3) potential opposition from local stakeholders including property owners who have raised sight and noise concerns, and fishermen who are concerned about impacts on their businesses. Reducing these barriers can unlock tremendous investment in clean energy and promoting domestic supply chains will ensure the investment and job creation is made in America. In developing offshore wind infrastructure, the US has an opportunity to support high-paying domestic jobs in the steel, manufacturing, and utility sectors.

It is critical that any offshore wind policy — perhaps with a phase-in period for domestic content — be designed to encourage a build out our domestic supply chain capabilities to support this new industry. Current commitments for Atlantic Coast wind development total 32GW — about three percent of total current U.S. capacity. This capacity could require deployment of about 4,000 turbines, creating tens of thousands of new jobs. About 20 GW of projects are in various stages of planning and development, implying up to $68 billion in capital investments, not including necessary investments in supporting infrastructure, shipping and port capacity, or workforce development.

New federal policy for transmission system build-out could include expanding DOE’s Loan Program funding to include offshore wind transmission network infrastructure and associated upgrades of coastal grid infrastructure, including public-private partnerships. Congress could also expand the investment tax credit to include transmission components from offshore collector platforms to onshore substation points of interconnection.

Other policies to encourage development of domestic supply chains could include reinstating the 48C Advanced Energy Manufacturing Tax Credit program to help spur development of a robust U.S. manufacturing capacity for American-made offshore wind turbines, nacelles, blades, subsea cables, and other equipment. In addition to domestic supply of steel and component parts, policies to encourage domestic supply base of critical metals and minerals for offshore wind turbines and structures could both preserve and increase jobs across the supply chain. A reinstated 48C tax credit would also benefit many other clean energy technologies.

Building out seaport facilities and related marine infrastructure is an important part of OSW implementation and the domestic supply chain. There are several financial incentives pathways that could incentivize the buildout of port facilities. One pathway is to expand the Maritime Administration’s Port Infrastructure Development Grants Program, Small Shipyards Grant Program, and America’s Marine Highway Program. A second pathway would be to increase funding for BUILD grants to upgrade U.S. ports for offshore wind installations, including heavy-duty cranes, turbine assembly areas, lay-down yards, deep draft berth and multi- modal transport connections. Decarbonization of port infrastructure operations, through electrification, or use of hydrogen or other net zero carbon fuels, should be integral to infrastructure modernization and should be strongly incentivized.

Building out the shipping fleet needed to construct, transport, and maintain offshore wind turbines is another opportunity for creating good paying American jobs. The government could provide financial incentives, grants, and loan guarantees for U.S. shipbuilders’ construction of vessels that will install and provide maintenance to OSW farms, transmission platforms, and seabed cables. These incentives may require some short-term Jones Act waivers as the domestic fleet is built.

EFI is working within the Labor Energy Partnership (LEP) with the AFL-CIO to further delineate key issues, develop an analytical agenda and pursue in-depth study of domestic supply chain. This in-depth study will seek to understand how the domestic supply chain for offshore wind can create robust and competitive global supply chains for this new industry. The analysis will map out the network of existing domestic companies, potential technology clusters, and timelines, and will catalogue incentives that are needed to ensure that public investments in offshore wind result in maximizing domestic, high-quality job creation.

Cross-Sectoral Technology Options with Infrastructure Needs

Net zero targets around the world — including what might be included in the new US NDC — are placing additional policy, innovation, infrastructure, and competitive pressures on all major economic sectors — transportation, electricity, buildings, industry, and agriculture — to deeply decarbonize.

In this regard, the US industrial sector is one of the most difficult sectors to decarbonize. The industrial sector and many subsectors, e.g., refining, chemicals, steel, cement, iron, and ammonia production, are essential to the US economy, its export markets, and jobs. The US iron and steel industry for example, while a major emitter, supported almost two million US jobs and $523 billion in economic output in 2019. The industrial sector is also a major consumer and producer of hydrogen and in many instances relies on both natural gas and oil as feedstocks or fuels for a range of processes.

Decarbonization options for the industrial sector include some electrification and increased efficiency, as well as carbon capture and sequestration and increased use of hydrogen — a clean energy carrier that can support the decarbonization of many critical sectors. Policy support for the buildout of the associated infrastructures that could be compatible, co-located or re-purposed, will reduce their emissions while helping to enable the ongoing economic benefits of these industries and ensuring they meet new requirements of export markets that may include the calculation of embedded emissions.

This buildout would also support the decarbonization of other sectors — the power sector, for example, could use both CCUS infrastructure as well as hydrogen — with an end state that could include a green hydrogen future, supported by natural gas and blue hydrogen with CCUS. Policy incentives, infrastructure investment, and market formation regulatory support will aid in this buildout that could ultimately support zero emissions industry, transportation, and power generation. Key cross-sectoral technologies and infrastructures include natural gas, hydrogen and CCUS, discussed in detail in this section of my testimony.

Improving and Transitioning Existing Natural Gas Infrastructure. Natural gas has become a major part of the U.S. — and global — energy mix over the last three decades, displacing higher emitting fuels and lowering greenhouse gas emissions. As many regions of the country begin to shift their policy targets toward net zero emissions, the emissions from natural gas, including methane emissions, must be reduced, or eliminated. I understand there are major proponents of “keeping it in the ground”. Responsible actions, however, acknowledge that natural gas currently provides the fuel needed for clean firm power (recall the 90 days with no wind in California), and is an essential fuel for industry, a major energy consuming sector that is difficult to decarbonize.

There are significant opportunities to leverage the natural gas system’s infrastructure to accelerate economy wide decarbonization. Natural gas fired generation provides the electric grid with firm, dispatchable power. It also enables a lower-cost transition. EFI’s study of New England showed that the cost of reaching a deeply decarbonized electric grid by midcentury was cut in half when natural gas with carbon capture and storage is included as a technology pathway. In many projected futures, a renewables-heavy electric grid would dispatch power from natural gas units only to maintain reliability and resilience.

EFI is currently assessing the global future of natural gas in a deeply decarbonized world, including the critical issues of supporting economic development. Initial findings from workshops held with think tanks in key world regions suggest that all regions have a significant interest in reducing emissions, and there are competing priorities that must also be considered. There is an emerging consensus that there will be a role for natural gas in a decarbonized global economy, specifically as an enabler of — and complement to — intermittent renewables for power generation, as a near-term “transition fuel” for fuel switching (especially away from coal and oil in power generation), as a feedstock in industry and for sectors that require high temperature process heat, and as a backup fuel in multiple end-use sectors.

For the natural gas system to be leveraged as part of the clean energy transition, however, its emissions must be reduced to meet climate policy targets. While there is a significant amount of debate around the current emissions from the gas sector, it is critical that the system’s owners and operators monitor, detect, and eliminate methane leaks and other direct and indirect emissions associated with its operations. New standards to regulate methane leakage are possible within existing authorities. Also, the Interior Department could update its regulations for methane emissions from infrastructures on federal lands; EPA can revise its rules on methane under the Clean Air Act; and FERC could consider the establishment of new end-to-end standards for methane leakage for all gas ultimately entering interstate commerce or seeking LNG export authorization. EFI is evaluating opportunities to create an improved data and analysis framework for better modeling methane leakage from the natural gas infrastructure, as a foundation for future policy and regulations to manage its emissions.

Natural gas, as noted, is also an essential fuel for the U.S. industrial sector, that currently has few options for mitigating CO2 emissions. Also, as noted, key industries — chemicals, plastics, iron, and steel — use natural gas as a fuel for process heat, and to produce the hydrogen used in a range of other industrial processes. These industries represent a major portion of U.S. GDP and employ hundreds of thousands of workers, across many regions of the country. Many of these industries will also be essential making the cement and steel needed for the grid, roads carrying EVs, and highly efficient buildings. Greatly reducing methane emissions along the supply chain deserves full commitment from industry.

Congress could also take a carrot-and-stick approach, pairing this regulation with financial support to offset rate impacts of gas pipeline improvements, as recommended in the QER. This policy could also specifically target improvements in communities that have a disproportionate pollution burden through carve-outs or other measures. In tandem with these programs, the federal government could also work to improve methodologies for measuring and estimating fugitive methane emissions.

Federal policy could also help propel innovation in natural gas infrastructure. Incentives for improvements could be strengthened if the improvements are particularly novel or effective at reducing emissions. Federal funding for RD&D could also help transform natural gas infrastructure for the net-zero world, including regional demonstration projects for hydrogen/natural gas blending or incentives for biogas.

U.S. LNG production and exports also have significant infrastructure needs, including ports and pipelines. Destinations for U.S. LNG include Brazil, Japan, South Korea, Mexico, India, the EU, and several other countries and regions. In many cases, this has supported climate change mitigation by gas substitution for coal. Analysis by the International Energy Agency concluded that coal to gas fuel switching reduced global emissions from the power sector by four percent. In China reduced emissions from its power sector by eight percent in 2018 alone and in the US by 14% that year.

Hydrogen: Both a Transition Option and an End State. Hydrogen is a clean energy carrier with multiple applications across every sector of the economy. Clean hydrogen could play an essential role in a low carbon economy as a zero-carbon “fuel” and was identified as one of ten technologies with significant breakthrough potential in EFI’s 2019 report, “Advancing the Landscape of Clean Energy Innovation.” EFI analysis in 2019 also concluded that hydrogen was one of four cross-cutting clean energy pathways that could help California meet its mid-century net zero targets.

There is significant interest among investors, utilities, oil and gas companies, and heavy industry to be part of the hydrogen solution. Opportunities for clean hydrogen end uses include industrial processes, heavy transportation, and power generation. Hydrogen from natural gas steam methane reforming (SMR) processes are already mature and meet almost all current domestic hydrogen demand. Producing “blue hydrogen” by capturing the carbon emitted via this hydrogen production approach is an off-the-shelf clean hydrogen solution. Using clean electricity to produce “green hydrogen” is also commercially available but requires further innovation to reduce costs.

The infrastructures needed for hydrogen market formation tend to be highly regional. Potential large-scale consumers, such steel, and power generation, tend to be in close proximity, and are already supported by the pipelines, power lines, roads, and other infrastructures needed for the clean energy transition. Finding similar synergies with other infrastructure needs for achieving deep decarbonization, including carbon capture and storage from a range of facilities, could lower the overall development costs of a hydrogen- fueled economy at the same time they provide pathways for a net zero future. These potential “hubs” could be formed in regions where various users of hydrogen across industrial, transport and energy markets are co-located and could benefit from shared infrastructure.

As with carbon capture and sequestration, large hydrogen users may have the business expertise and capital availability to support an end-to-end hydrogen supply chain for their own uses. For clean hydrogen to scale, however, new infrastructure investments will likely be required to enable market hubs where several producers and consumers are co-located and benefit from economies of scale.

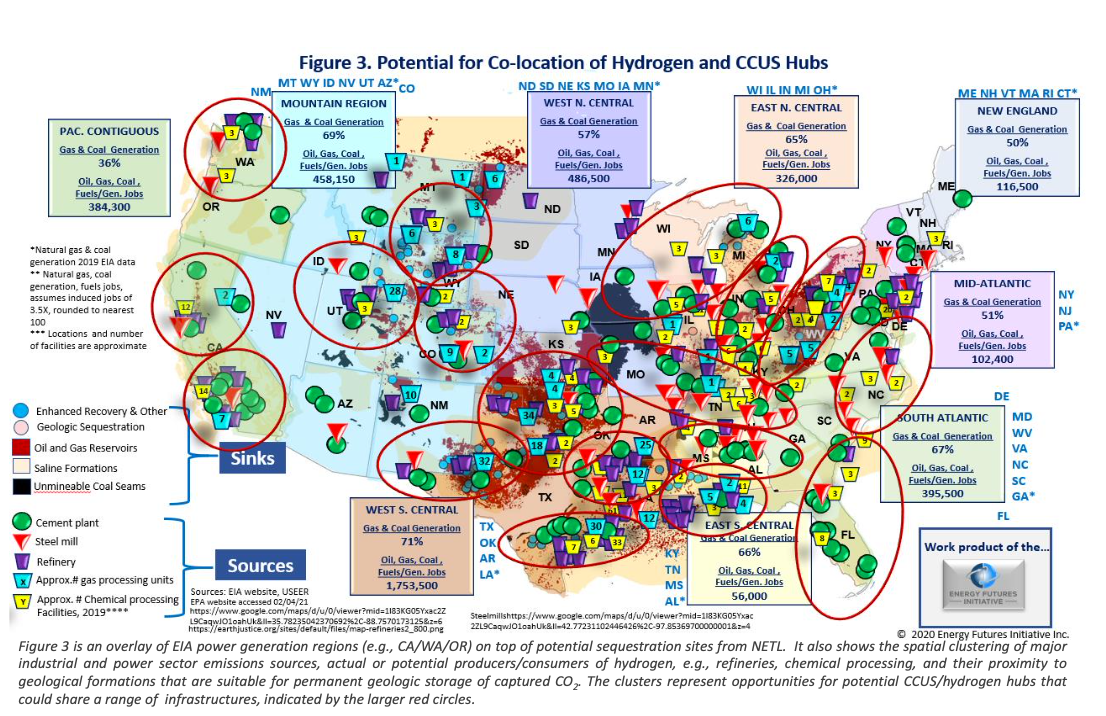

Figure 3 offers a snapshot of where joint CCUS-hydrogen market hubs might form based on existing industrial clusters that are major GHG emitters, produce or consume hydrogen, have substantial fossil-generated power generation, and potential sequestration sites for captured CO2. Within one hub, there could be a mix of blue hydrogen and CCUS for different categories of industrial plants.

The formation of hydrogen hubs may develop along a similar path to natural gas distribution systems, requiring policy enablers, regulatory frameworks, and new business models. EFI is investigating the policies needed for hydrogen market formation in the United States, actively working with major stakeholders to profile current investments in clean hydrogen across the emerging hydrogen value chain: production, transport, and end use. This will help EFI to develop regional case studies to evaluate the specific opportunities and challenges of building out hydrogen infrastructure and markets. Federal and state governments should work together to incentivize early-mover hydrogen-CO2 hubs, perhaps through approved multi-state regional compacts.

Federal financial incentives will be a key part of developing hydrogen infrastructure. These could include tax incentives for production, installation of supply infrastructure, purchase of hydrogen-fueled vehicles, or use in industrial and commercial contexts. Infrastructure-specific incentives will be key to solving the chicken-and- egg problem of hydrogen supply. Another form of incentive could be use of public procurement power, such as purchase targets for fuel-cell vehicles. A carbon border adjustment for energy-intensive goods could also encourage industrial producers to be early hydrogen adopters.

Federally funded innovation will also be key to developing a hydrogen economy. One possible path forward toward hydrogen hubs is the establishment of a federally assisted demonstration program, which would create two to three hubs that could be used as examples for the rest of the country. Expanded RD&D could reduce cost of blue or green hydrogen production, and further develop new configurations like nuclear-powered production. Innovation could also be important to developing alternative forms of hydrogen carriers.

CO2 Transportation and Storage. Carbon capture utilization and storage (CCUS) will be an essential element in any portfolio of actions for meeting a mid-century net zero goal. As one indicator of scale — the EFI study of the California decarbonization policies and plans found that CCUS could contribute to a reduction of around 60 MMTCO2, representing nearly 30% of the State’s 2030 emissions reduction target. Scaling CCS projects nationwide will require significant quantities of CO2 that must be captured and transported for geologic storage or other disposition. CO2 transport and storage also will be required to support carbon removal technologies including biomass with carbon capture and storage (BECCS), Direct Air Capture (DAC), and in-situ carbon mineralization.

Very large carbon management projects, such as at some power generation facilities or large industrial emitters, may deploy CCUS as a single, wholly owned and operated project. Many other CCUS and direct carbon capture projects, however, will need to rely upon the economies of a large-scale carbon management hub, where CO2 transport and storage is provided by a 3rd party deployment of a spoke-and-hub architecture. Congressional action can provide needed stimulus for the formation of such regional CO2 hub infrastructures.

Building a CO2 pipeline infrastructure raises the challenges of obtaining rights of way and the complexity of permitting. The EFI analysis of CCUS deployment opportunities in California showed that project permitting is one of the most significant impediments to progress for new CCS project developers. CCS projects involve permitting for at least two processes (capture and storage) and each process may include multiple—and up to a dozen—state and federal agencies that may not be familiar with CCS permitting processes. CO2 transportation needs add to the complexity when projects have widely separated source and sink. Congressional action to encourage repurposing of existing rights of way to allow for CO2 pipelines to co-locate with other infrastructures would be beneficial. Policy direction to improve coordination of permitting, such as the provisions of the proposed USEIT Act, also would be very beneficial. Finally, additional financing incentives, such as an expanded application of the DOE Title XVII loan guarantee program or new financial incentives such as those in the SCALE Act, could accelerate the pace of buildout of CO2 pipeline infrastructure.

In addition to pipeline infrastructure, the other key element of CO2 infrastructure is the buildout of geologic storage hubs. The DOE Carbon Storage Assurance Facility Enterprise (CarbonSAFE) program has supported the characterization studies needed to assess the feasibility of storage hub locations. This work could be accelerated with additional funding and expanded in scope to enable the build out of several of the CarbonSAFE sites into regional storage hubs. The September 2019 EFI Report, Clearing the Air, discussed in more detail the opportunity to expand and accelerate the storage hub concept.

Finally, creating a large-scale CO2 management infrastructure will require the development of new business models and regulatory frameworks. The creation of 3rd party carbon management entities—perhaps a CO2 utility model – provides a substantial new business opportunity for firms with expertise and experience in managing fossil fuel production and processing; the 3rd party could be organized as a regulated utility due to the non-competitive nature of shared transportation and storage infrastructure. New regulatory structures, with an emphasis on encouraging deployment on a regional scale, also will be needed. Management of liability, particularly in cases where the entity managing the CO2 storage is different from the entity that generated the CO2, will be critical. The monitoring, reporting and verification (MRV) requirements of the current EPA Class VI permitting program may need to be supplemented with some form of an insurance pool to address liability for CO2 leakage from third party sequestration sites that are managing CO2 from multiple sources. An insurance pool could more appropriately balance risks between generators of CO2 and owner/operators of CO2 storage sites, lowering an impediment to project finance and development.

Other Cross-cutting Needs for Expediting Clean Energy Infrastructure Buildout

There are other issues, policies and potential options that should be considered in the context of infrastructure incentives and policies to aid in the clean energy transition. These include protection of global supply chains and incentives for building domestic capacity; the growing interdependencies of key infrastructures; broadband access; the generic need for expedited infrastructure siting; and cyber-security.

Protecting Global Supply Chains, Building Domestic Options. Increased electrification, new clean energy technologies, LNG exports to allies, and COVID have raised issues about the security of global supply chains and the need to focus on creating, building, and reinvigorating domestic options. As noted, electrification and the buildout of transmission lines, and variable renewable generation technologies, will mean dramatic increases in demand for steel, EV battery manufacturing, the mining, processing, and refining of key metals and minerals including lithium, cobalt, manganese, and nickel, and cathode and anode production. And this demand growth is not occurring in a vacuum. Net zero targets are increasing demand—and competition—for steel, EVs, batteries, and other key materials and technologies around the world.

The need to address these issues was underscored by President Biden’s Executive Order 14017, America’s Supply Chains, which notes that “More resilient supply chains are secure and diverse—facilitating greater domestic production, a range of supply, built-in redundancies, adequate stockpiles, safe and secure digital networks, and a world-class American manufacturing base and workforce. Moreover, close cooperation on resilient supply chains with allies and partners who share our values will foster collective economic and national security and strengthen the capacity to respond to international disasters and emergencies.”

Figure 3 underscores some of the critical issues that drive the need for such an order and highlights key areas of focus for building up domestic supply chain infrastructures. From an energy perspective, the EO focuses on two key areas: batteries and industrial supply chain needs. Creating domestic options for both batteries and critical industry needs should be considered essential components of a clean energy future.

Protecting global supply chains, growing domestic industries and options, and investing in innovation, are all critical to providing the energy and associated infrastructures for a clean energy future. This should, in fact, inform and broaden the definition of both energy infrastructure and energy security to help ensure policymakers are providing adequate direction and incentives to support the supply chains and industries needed for a clean energy future.

Policies that could enhance US capacity in these areas include:

- protection of global supply chains for minerals/metals needed for wind, solar and batteries;

- support for new domestic, environmentally responsible mining activities for key minerals/metals, including associated infrastructure;

- an increase in the capacities, capabilities, and associated infrastructures needed for key mineral chemical processing/refining and battery manufacturing; and

- the promotion of humane mining conditions around the world.

Infrastructure Interdependencies. The Texas experience also highlights the growing interdependencies of critical infrastructures and points to a key need going forward. In the case of the Texas deep freeze, it was the electricity, gas, and water infrastructures. These three infrastructures—and other critical infrastructures—do not sit neatly together in law, regulation, oversight and, relevant to today’s discussion, within either committee or federal agency jurisdictions. This needs significant analysis to identify changes in policy and program structures that might be needed to accommodate the new realities of clean energy systems and the interdependencies of critical infrastructures.

Broadband Access. Energy infrastructures are also increasingly dependent on digital technologies, making broadband access a critical part of modernizing those infrastructures. In fact, the COVID-19 pandemic has demonstrated just how dependent we are on internet access in all facets of modern life. The increasing IT connectivity of energy systems could also help accelerate the low-carbon transition, facilitating digital infrastructures that allow for more efficient energy use and integration of new kinds of resources. Increased public investment can mitigate existing inequities in broadband access and close the gap to universal deployment. There are also possible synergies between broadband and energy infrastructure: pursuing the physical improvements and expansions required for each system in parallel can create opportunities for cost savings and more efficient permitting.

Infrastructure Siting Challenges. In addition, the urgency of climate change and the need for a range of new infrastructures begs siting questions and the speed at which new infrastructure can be built. The list of delays in siting key energy infrastructures is long and includes the Northern Pass Project, Cape Wind, the Winder Catcher project, Sun Zia and the Clean Line Energy project that we worked on at DOE when I was Secretary.3 There are existing rights of way, e.g., for railroads, interstate highways, gas and oil pipelines, and existing electricity transmission that might be re-purposed to help expedite the siting of new clean energy infrastructures. It is possible that such re-purposing could also be monetized, aiding in reducing financial losses to industries that have relied on revenues from conventional energy. Coal transport, for example, has been a significant source of revenue for freight rail, but coal demand has declined significantly over the last several years; with federal support and guidance, railroad rights of ways might be valuable for more rapidly siting new infrastructures needed for a clean energy future. An examination of existing authorities and the development of new authorities to support the re-purposing or multi-purposing of existing rights of way could help accelerate the transition to a clean energy future.

Cyber-Security. Ensuring cybersecurity must be a fundamental consideration when modernizing and expanding U.S. energy infrastructures. The modern energy system — including the electric grid, natural gas systems, on- road and air transport, and manufacturing — will become increasingly dependent upon cyber-physical systems. As the energy system becomes smarter through the integration of information and operational technologies, the risks posed by cyber-attacks will increase. There are, however, also opportunities to engineer cybersecurity into the future energy infrastructure in a way that supports decarbonization, operational resilience, and security. This will include developing intrusion detection systems into critical components, expanding our capability to monitor and track the supply chains for critical components, embedding cybersecurity into training across the entire workforce, building on our strong information sharing programs between the government and private sector and among industry itself. The recently revealed SolarWinds attack shows how cybersecurity must be applied along the entire supply chain for infrastructures. These and other measures should be integrated into how we build energy infrastructure in the United States.

Transitioning Conventional Energy Jobs to the Clean Energy Jobs of the Future

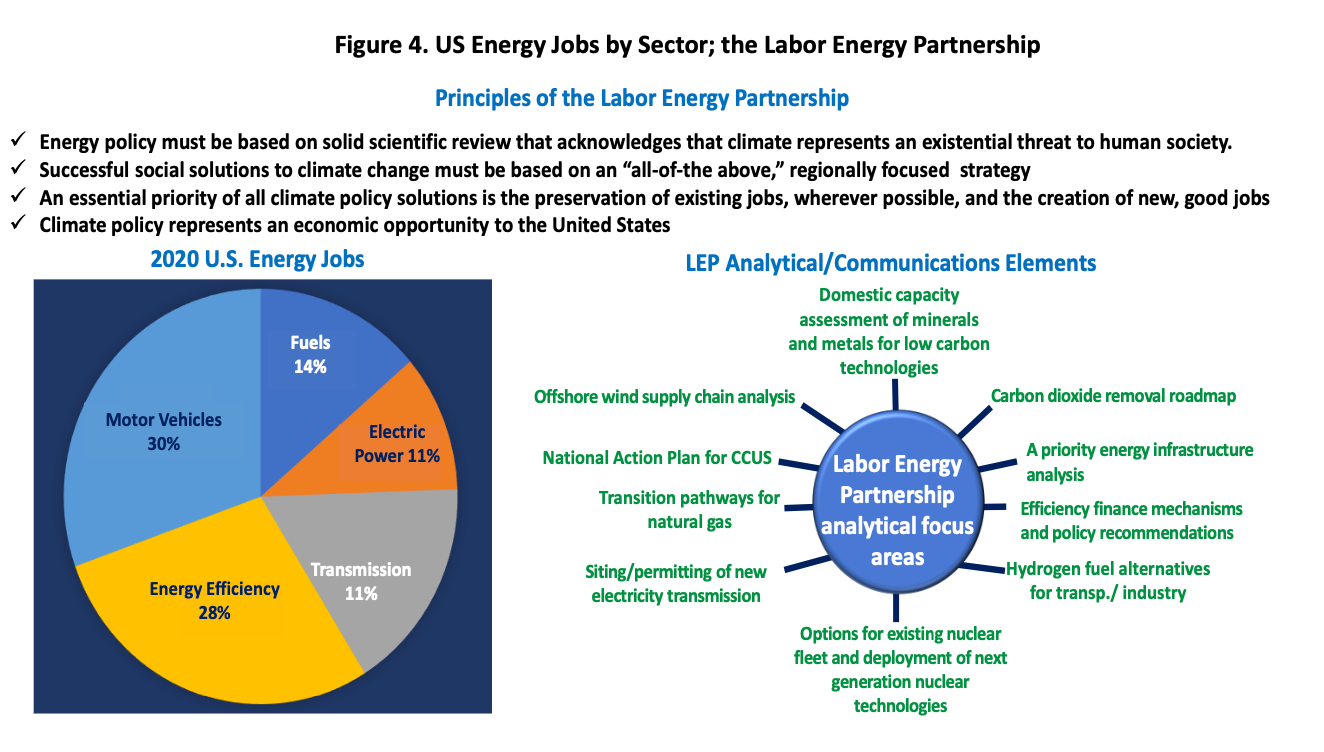

Another significant activity we are engaged in that relates directly to the topic of today’s hearing is the establishment of the Labor Energy Partnership (LEP). Last Earth Day, the Energy Futures Initiative (EFI) and the AFL-CIO formed the LEP. This is a joint effort of both organizations to develop a framework the 21st Century energy system that creates and preserves quality jobs while addressing the climate crisis.

The LEP’s four guiding principles demonstrate its approach to a range of issues, including grid modernization, offshore wind, CCUS, and hydrogen. These principles are: 1) Energy policy must be science-based; 2) We need an “all-of-the-above” energy strategy that is regionally focused, flexible, and preserves optionality; 3) preserving jobs, while creating new ones, is essential to climate policy; and 4) there are significant economic opportunities in the development and deployment of clean technologies and infrastructure. Figure 4 below highlights these principles as well as the 10 areas of analytical and outreach focus that guide the activities of the LEP. It also shows the distribution of energy jobs in 2020.

The Labor Energy Partnership is currently analyzing the policies needed to site and permit new electricity infrastructure projects in the near-term. It is also evaluating policy solutions to ensure rapid development of offshore wind resources along the east and west coasts, and in the Great Lakes region. In line with its wholistic approach to policy analysis, the LEP is considering local economic impacts, the opportunity to onshore the offshore wind manufacturing and supply chains, the social equity and environmental justice concerns, and the lessons learned from the existing global market.

In addition to its work with the AFL-CIO, the Energy Futures Initiative, in partnership with the National Association of State Energy Offices, conducts an annual energy jobs survey that we started at DOE when I was Secretary. The previous Administration discontinued this survey. Understanding its importance, EFI and NASEO have sustained this critical work and released a five-year trend analysis of energy jobs last year. The data in this summary analysis (all pre-COVID) indicated that energy jobs were created at twice the rate of overall jobs in the economy, a critical consideration as we work on COVID recovery.

Special attention needs to be paid to conventional energy jobs and providing the training and cross-walking to clean energy jobs. Again, offshore wind provides an example. The skills of oil and gas workers who have experience with building and maintaining offshore drilling platforms can be transferred to offshore wind platform construction and maintenance. CCUS offers another opportunity to apply the subsurface and pipeline construction and maintenance knowledge and skills of oil and gas workers to work on large scale decarbonization infrastructures. This underscores some of the key reasons why we formed the Labor Energy Partnership with the AFL-CIO last year.

Transforming our Energy Systems: Regional Infrastructure Options are Critical

Last, and perhaps most important for the members who represent varied constituencies across the country, we need to encourage and provide policy support for regional solutions to climate change and the associated infrastructure needs. EFI has undertaken multiple projects on regional decarbonization, including reports on California and New England (in collaboration with E3), and a forthcoming report on New York City (along with ICF and Drexel University). The resources, infrastructures, emissions profiles, innovation, and policy needs vary greatly by region of the country — a “one size fits all” approach to policy and financial support will likely impede, not accelerate progress towards deep decarbonization. EV charging infrastructures will, for example, look very different in both rural and urban areas, where the typical “suburban EV model mindset” and its associated infrastructure will have little relevance.

Access to broadband offers another example, affecting the degree to which a city, town or region could be considered for any policy support as a “smart community”. Smart Community initiatives must be understood and guided by digitization as the foundation for economic growth and entrepreneurial activity. While important to focus on initial apps (e.g., smart streetlights), a critical focus should be ensuring the buildout and protection of the digital backbone infrastructure that is the basis for an entrepreneurial economy in cities and communities. This backbone starts with the integrated cutting-edge smart electricity and telecommunications systems linked to big data, sensors, real-time modeling, and artificial intelligence capabilities. The backbone infrastructure will provide unforeseen entrepreneurial advances in the smart city/community and act as a magnet for talent. In addition, all these issues and considerations must accommodate regional, state, and local needs and differences, including urban and rural differences.

______________________________________

Mr. Chairman, Ranking Member Rodgers, members of the Committee, I appreciate the opportunity to testify today on critical energy infrastructure issues. The Lift America Act is a very important and necessary step towards supporting the infrastructure we need for deep decarbonization of energy systems and consuming sectors and for building resilience into our infrastructures in anticipation of increasingly extreme weather patterns. I look forward to your questions.

Watch the full hearing here.

(Share this post with others.)