Only 632 of the 16,877 pieces of legislation introduced in the U.S. Congress since January 2021 have become law. The Inflation Reduction Act (IRA)—named the most transformative climate bill in American history—is among them.

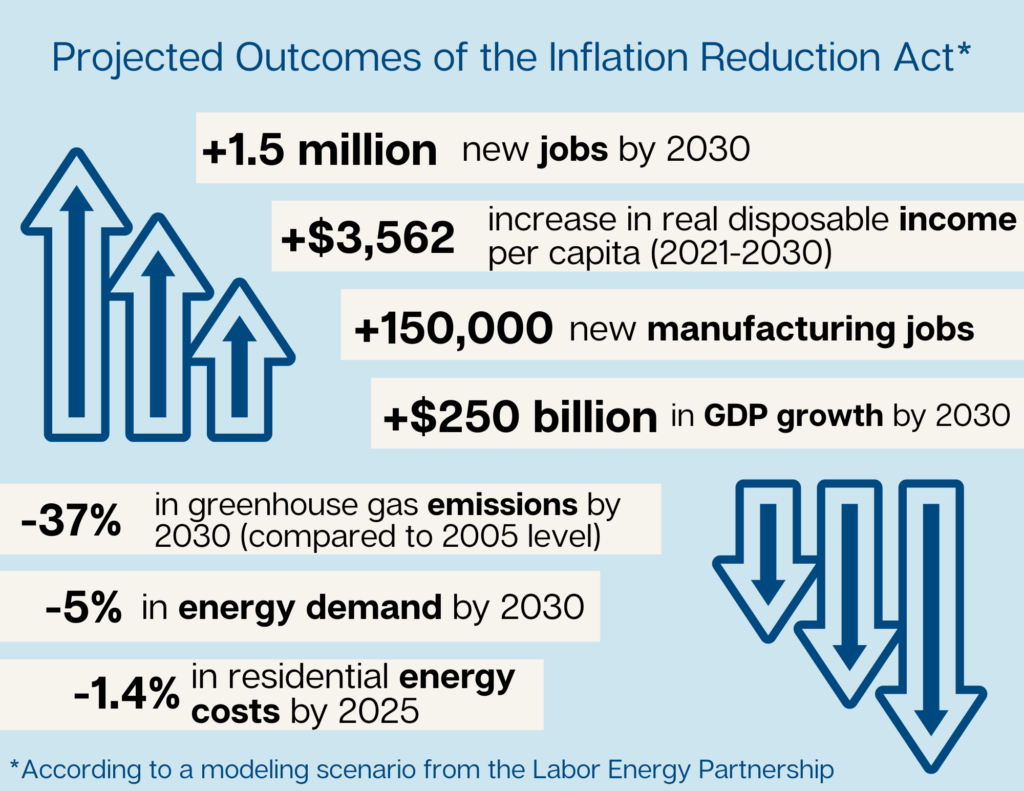

According to an analysis by the Labor Energy Partnership (LEP)—which is a joint effort of the Energy Futures Initiative (EFI) and the American Federation of Labor & Congress of Industrial Organizations (AFL-CIO)—the IRA stands to positively impact a range of issues at the forefront of the national agenda: inflation, energy security, and climate change.

LEP shared the analysis with members of Congress and their staff, who ultimately influenced support for the IRA as it moved through Congress to become law in August 2022. The data continues to inform policymakers and the public months later and has been cited in op-eds and news coverage. EFI CEO Ernest Moniz shared the results of the LEP analysis on LinkedIn and Twitter, and we at EFI developed an animated graphic to show many of the projected impacts. AFL-CIO also shared a press release of the analysis and its main findings.

Don’t just take our word for it—let’s look to the analysis itself…

LEP’s modeling scenario found that provisions in the IRA will be able to cut greenhouse gases by 37 percent by 2030 (compared to 2005), add 1.5 million additional jobs to the U.S. economy, and spur domestic manufacturing capacity. IRA provisions are expected to boost the economy by an additional $250 billion by 2030, increase per capita personal income by $3,562 (2022 dollars) by 2030, drop overall demand by 5 percent by 2030, and cut residential energy costs by 1.4 percent.

“The IRA is the single most significant step to date for building a resilient clean energy economy,” Moniz said.

These results are expected to come from the IRA’s incentives for energy innovation and efficiency. The IRA’s investment in energy security and climate change involves a slew of incentives to strengthen clean energy supply and demand, including tax credits for suppliers and tax rebates for consumers.

The IRA also offers additional incentives to finance clean energy facilities and projects through low-interest government loans and other tax credits. The IRA’s tax credits span clean energy technologies and sources: solar, wind, carbon capture, nuclear, clean hydrogen, electric vehicles, and more.

The IRA’s wide scope of incentives positions it to propel the clean energy transition by targeting a diverse portfolio of clean energy options. Many of the energy technologies in the IRA are part of EFI’s portfolio of science-based analysis.

Clean hydrogen is especially central as a potential “new natural gas,” according to Moniz. The IRA incentivizes clean hydrogen through a production tax credit for projects with life cycle emission levels below 4 kilograms of carbon dioxide equivalent/kilogram of hydrogen. The IRA, especially when coupled with other significant climate policies, is likely to accelerate the development of clean hydrogen and other low-carbon energy sources.

As the 117th Congress heads into the final days of its term, recent climate policy—Bipartisan Infrastructure Law, CHIPS and Science Act, and especially, the IRA—now depends less on policymaking and more on successful implementation to effectively tackle the climate crisis. As the largest climate investment in American history, and as highlighted by LEP’s analysis, the IRA has the potential to reshape U.S. climate leadership by targeting energy innovation.

— Jaycee Scanlon, Communications Fellow

(Share this post with others.)